Avoid These Mistakes With Your IRA, Part 2

One of the key rules to bear in mind when rolling over money from a former employer's 401(k) into an IRA is the 60-day rule—that is, you have 60 days to complete the rollover.

.jpeg)

A follow up to Part 1.

One of the key rules to bear in mind when rolling over money from a former employer's 401(k) into an IRA is the 60-day rule—that is, you have 60 days to complete the rollover. If you don't complete the rollover within that 60-day window and you're younger than 59 1/2, the amount will be treated as an early distribution and be subject to taxes and a 10% penalty. That's why it's a good idea to have your providers deal with one another on the rollover. That way, you never put your hands on the money, and the financial-services providers know the need to complete the rollover in a timely fashion.

Mistake 6:

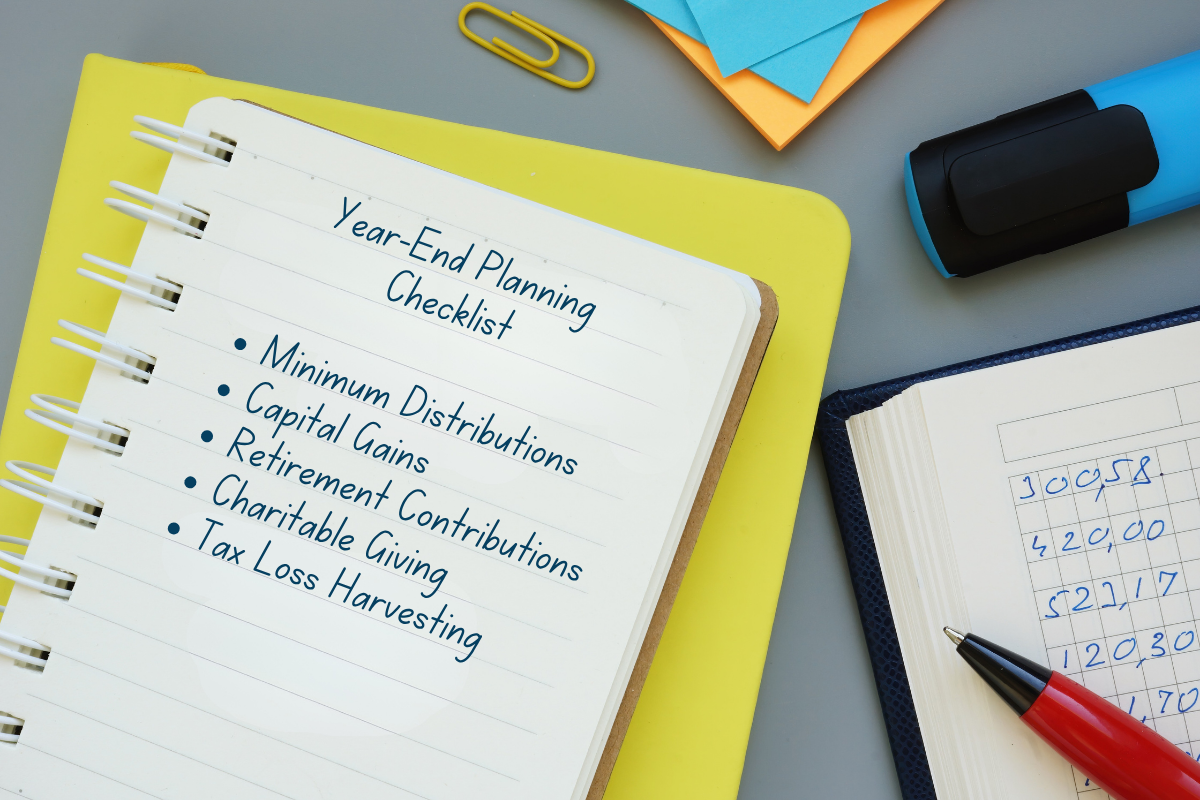

Letting your brokerage or fund company call the shots on your RMDs. Investors who are age 70 1/2 know that that's the year in which they must begin taking required minimum distributions from their Traditional IRAs and 401(k)s. Those RMDs are taxable. But RMD season also gives you the opportunity to make lemonade by being strategic about the investments from which you pull the distributions. Did your stock holdings shoot up in 2013? If so, it may be an ideal time to trim those holdings to restore your asset allocation back to your targets. As long as you take the right amount of RMDs from all accounts of a given type (you can't mix and match RMDs from your 401(k) and IRA, for example), you'll be on the up and up with the IRS. By contrast, if you leave it to your brokerage fund company to decide where to pull the money from, it may not be to your advantage. They may pull the money in accordance with their default rules, often proportionally from each holding.

Mistake 7:

Not appealing a penalty on missed RMDs. Fail to take the RMD, and you'll be on the hook not just for the taxes, but also a 50% penalty (excise tax) on the amount that you should have taken and did not. That said, there may be legitimate reasons that you (or a loved one) missed the RMD. Perhaps you were ill, for example, or perhaps your parent is in the early stages of dementia and you haven't yet implemented a system to help with financial matters. The first step is to take the required distribution as soon as possible. Then fill out IRS form 5329, requesting a waiver of the 50% excise tax on missed distributions and providing the reason. Assuming the IRS finds that the missed RMD owes "to reasonable error and you are taking reasonable steps to remedy the shortfall," you should be able to get that penalty waived.

Mistake 8:

Spending RMDs you don't need. In addition to the taxes due on RMDs, many retirees grouse about the distributions because they're taking them over their desired distribution rates. Shortly after they commence, RMDs quickly escalate well above the distribution rates that much research deems prudent and up into the range of 6% or 7%. Of course, as retirees age, they can arguably take more from their portfolios than they could earlier in their retirement years because their life spans are shorter. Additionally, your IRA may not be your only retirement resource; you can forgo distributions from other account types so that your RMDs don't take you over your planned spending rate. But if the RMD requirements are going to take you over your planned distribution rate, you can reinvest the money back into your retirement accounts—either a taxable account or a Roth IRA.

401(k) plans are long-term retirement savings vehicles. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 1/2, may be subject to a 10% federal tax penalty. Funds in a traditional IRA grow tax-deferred and are taxed at ordinary income tax rates when withdrawn. Contributions to a Roth IRA are not tax-deductible, but funds grow tax-free, and can be withdrawn tax free if assets are held for five years. A 10% federal tax penalty may apply for withdrawals prior to age 59 1/2. This is for informational purposes only and should not be considered tax or financial planning advice. Please consult a tax and/or financial professional for advice specific to your individual circumstances.

News and insights for your financial future.

Feel good about

your financial future.

Tailored guidance to help you make smart financial choices

Comprehensive planning and holistic wealth management

Advice that integrates with your values at every stage of life